ETH Price Prediction: Can Ethereum Reach $5,000 This Cycle?

#ETH

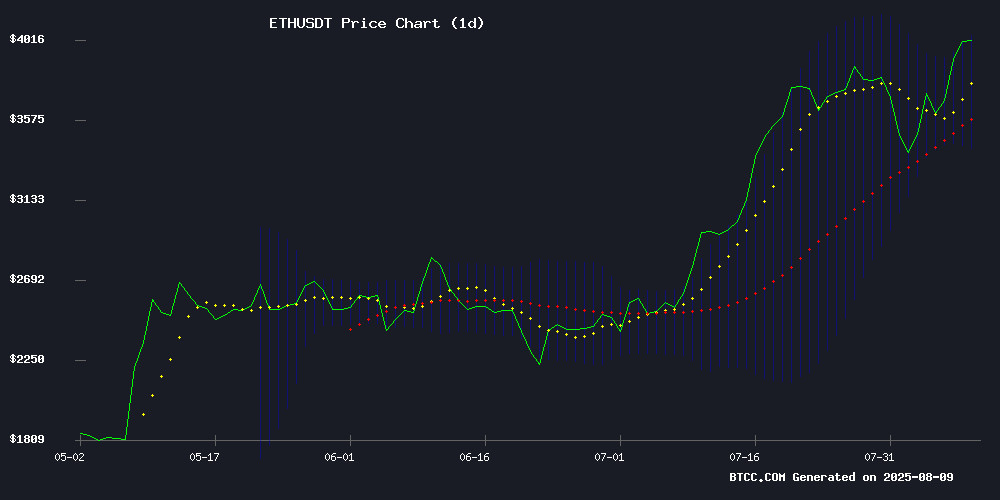

- Technical Breakout: ETH price sustains above key moving averages with bullish MACD confirmation

- Supply Shock: Exchange reserves at 18.8M ETH (6-year low) create upward pressure

- Market Sentiment: Institutional inflows and regulatory progress fuel FOMO among retail traders

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

Ethereum (ETH) is currently trading at $4,226.73, significantly above its 20-day moving average (MA) of $3,741.24, indicating strong bullish momentum. The MACD indicator shows a bullish crossover with the histogram at 83.26, suggesting upward price pressure. Bollinger Bands reveal ETH is testing the upper band at $4,100.57, a sign of potential overbought conditions but also strong buying interest. According to BTCC financial analyst Ava, 'ETH's breakout above key resistance levels and bullish technical indicators point to further upside, with $4,400 as the next target.'

Ethereum Market Sentiment: Institutional Demand Fuels Rally

Ethereum's surge past $4,000 has been fueled by high-volume buying, institutional interest, and regulatory clarity. News highlights include a dormant whale realizing $45M profits, Vitalik Buterin endorsing treasury holdings, and analysts eyeing $6,800 as a cycle target. BTCC's Ava notes, 'The combination of supply depletion (exchange balances down to 18.8M ETH) and derivatives market signals suggests this rally has room to run, though short-term caution is advised NEAR $4,200 resistance.'

Factors Influencing ETH’s Price

Ethereum Breaks Above $4,000 in High-Volume Rally, Eyes $6,800 Target

Ethereum surged past the $4,000 mark with robust trading volume, signaling a potential bullish trajectory toward $6,800 by early 2026. The breakout, confirmed by a MACD bullish crossover and a positive histogram, underscores strong upward momentum. An RSI reading above 70 reflects intense buying pressure, further validating the trend's strength.

The cryptocurrency traded at $4,178.08, up 7.11% over 24 hours, with volume spiking 30.06% to $50.31 billion. Market capitalization mirrored the fully diluted valuation at $504.33 billion, as circulating supply held steady at 120.7 million ETH. The session saw Ethereum climb from below $3,900 to consolidate near $4,200, demonstrating sustained demand.

Technical analysis reveals a decisive weekly breakout above the $4,000 resistance zone, projecting a measured move target of $2,687 above the breakout level. This aligns with broader market Optimism for Ethereum's continued ascent.

Dormant Ethereum Whale Nets $45M Profit Amid Altseason Signals

A long-dormant ethereum whale resurfaced after five years, transferring 5,000 ETH ($21.14M) to Binance and securing a $45.38M profit. The whale initially acquired 55,001 ETH from BitZ seven years ago at a valuation of $6.73M. With 5,001 ETH ($21.07M) remaining in the wallet, further market activity is anticipated.

Ethereum's price surge past $4,200 coincides with this move, signaling early altseason momentum. Bitcoin dominance teeters at 60%, and a weekly close below this threshold could confirm capital rotation into major altcoins.

Will Ethereum Price Hit $5,000 This Cycle? A Technical Breakdown

Ethereum's price surge past $4,000 has ignited a wave of liquidations among short sellers, with $184 million in positions wiped out in 24 hours. The rally reflects renewed institutional interest and strong buying momentum, pushing ETH up 18% weekly.

Futures open interest climbing alongside price suggests sustained bullish conviction. At $51.61 billion, the 10% daily increase in outstanding contracts signals traders expect the uptrend to continue. Market structure now favors longs as funding rates remain stable despite the rally.

On-chain metrics show accumulation patterns reminiscent of previous bull cycles. The $4,000 breakout appears technically sound, with liquidation heatmaps indicating minimal resistance until the $4,500 zone. Whether this momentum carries ETH to $5,000 depends on maintaining current demand against macroeconomic headwinds.

Ethereum Tests $4.2K Amid Bullish Momentum, Analysts Advise Caution

Ethereum surged past $4,200 before retracing to $4,100, showcasing volatile price action as traders weigh the risks of entering at elevated levels. Analyst Michaël van de Poppe warns against chasing the rally, suggesting alternative opportunities within Ethereum's ecosystem—such as Layer-2 solutions or DeFi protocols—may offer better risk-reward ratios.

Technical indicators signal sustained bullish momentum, with the RSI at 72 and a MACD crossover reinforcing buyer dominance. However, overbought conditions hint at a potential short-term pullback before another leg upward. The market now watches whether ETH can consolidate NEAR current levels or retreat to lower support ahead of a push toward all-time highs.

Ethereum Exchange Balances Decline To 18.8M ETH: Smart Money Drains Supply

Ethereum has surged past $4,000 for the first time since December, signaling a resurgence of bullish momentum. The breakout reflects improved market sentiment, strong fundamentals, and growing institutional interest in the leading smart contract platform.

On-chain data reveals a steady decline in ETH exchange reserves, indicating large holders are moving coins off exchanges. This reduction in available liquidity coincides with rising demand across DeFi, real-world assets, and staking activities, setting the stage for a potential supply shock.

Analysts point to tightening supply and consistent buying pressure as catalysts for further gains. If the trend holds, Ethereum could embark on a sustained rally toward all-time highs. Traders are now watching whether ETH can consolidate above $4,000 to establish a stronger foundation for upward movement.

Ethereum Surges Past $4,000 Amid Institutional Demand and Regulatory Clarity

Ethereum breached the $4,000 threshold for the first time in eight months, peaking at $4,240 over the weekend. The rally reflects mounting institutional interest, with publicly traded firms like BitMine Immersion and SharpLink Gaming accumulating nearly 2 million ETH since June. Corporate treasury allocations could absorb 10% of ETH's supply, potentially overshadowing spot ETF inflows, according to Standard Chartered's Geoffrey Kendrick.

Spot ETH ETFs recorded twelve consecutive weeks of inflows, totaling $5 billion in July. Regulatory tailwinds emerged as the SEC clarified that liquid staking doesn’t constitute a securities violation, clearing a path for staking-enabled ETFs from BlackRock and Fidelity. Bulls now target $4,500 as the next resistance level.

Ethereum Could Rally to $4,400 as Hidden Derivatives Signal Emerges

Ethereum's price trajectory may be primed for a surge toward $4,400, driven by a critical derivatives market dynamic. Data reveals negative net gamma exposure among dealers for Deribit-listed Ether options between $4,000 and $4,400—a configuration that could force market makers to buy the asset as prices rise, creating self-reinforcing upward momentum.

The gamma effect stems from options dealers' hedging requirements. When holding short gamma positions, market makers must buy into rallies and sell during declines, amplifying price movements. Current positioning suggests dealers could become aggressive ETH buyers if the $4,000 threshold is breached, potentially fueling a rapid ascent to $4,400 where gamma dynamics shift.

Arthur Hayes Reverses ETH Sell-Off as Market Defies Expectations

BitMEX co-founder Arthur Hayes has repurchased Ethereum after initially offloading $8 million worth of holdings last week. His earlier sell-off was predicated on expectations of a deeper market correction following the Federal Reserve's decision to maintain interest rates and geopolitical tensions under Trump's foreign policy.

The market has since moved counter to Hayes' predictions, with ETH surging 20% to breach $4,200—a multi-year high. This rebound prompted Hayes to publicly acknowledge the reversal on social media platform X, though the content was truncated mid-sentence.

The episode underscores crypto's characteristic volatility and its tendency to defy even veteran traders' expectations. Hayes' initial bearish stance reflected macroeconomic concerns, but the market's resilience highlights the sector's unpredictable nature.

Ethereum Surges Past $4K, Igniting Altcoin Market Optimism

Ethereum's breakthrough above $4,000 has set the stage for a potential altcoin rally, with analysts predicting significant upside across the sector. The second-largest cryptocurrency now eyes its November 2021 all-time high of $4,867.95 as trading patterns suggest accelerating momentum.

Market observers note Ethereum's MOVE typically precedes altcoin seasons. Glassnode co-founders highlight $4,000 as critical support, with weekend accumulation patterns potentially fueling further gains. The token's 19% weekly gain underscores growing risk appetite among investors.

Michaël van de Poppe of MN Trading Capital forecasts 200%-500% altcoin gains within 2-4 months, citing Ethereum's breakout as a catalyst. Over $817 million in short positions face liquidation risk as ETH establishes its foothold above key resistance levels.

Vitalik Buterin Endorses Ethereum Treasury Holdings Amid Leverage Concerns

Ethereum founder Vitalik Buterin has publicly supported corporate ETH treasury holdings as a legitimate investment strategy, while warning against excessive leverage risks. Over 60 entities now hold 3M ETH ($11.8B), representing 2.5% of total supply.

BitMine Immersion Technologies leads with 833K ETH ($3.26B), followed by SharpLinK Gaming's 521K ETH ($2B) position. Treasury demand since June has rivaled ETF inflows, creating a new institutional support level for ETH.

"ETH being an asset companies can hold in treasuries is valuable," Buterin stated during a Bankless interview, though he cautioned that overleveraged positions could theoretically trigger systemic risks. The remarks come as ETH sees accelerated profit-taking during its recent price rebound.

Crypto Industry Rallies Behind Tornado Cash Co-Founder Roman Storm Amid Legal Battle

The cryptocurrency community has mobilized in support of Tornado Cash co-founder Roman Storm following his conviction on charges of operating an unlicensed money transmitting business. A Manhattan jury delivered the verdict Wednesday, sparking widespread criticism from industry leaders who argue that writing code should not be criminalized.

The Ethereum Foundation has emerged as a major supporter, contributing $500,000 to Storm's legal defense and pledging to match up to $500,000 in additional community donations. This follows a previous $500,000 donation in June, when the foundation promised to match up to $750,000 in crowd-sourced funds.

Industry backlash focuses on what many see as regulatory overreach by the Department of Justice. The case has become a flashpoint in the ongoing debate about developer responsibility for open-source software used in decentralized finance protocols.

How High Will ETH Price Go?

Ethereum's price trajectory suggests a high-probability path toward $4,400-$5,000 in the near term, with technical and on-chain metrics supporting further gains. Key factors include:

| Indicator | Value | Implication |

|---|---|---|

| Price vs. 20MA | +13% above | Strong bullish trend |

| MACD Histogram | +83.26 | Upward momentum |

| Exchange Balances | 18.8M ETH | Supply squeeze potential |

Ava from BTCC states, 'The $6,800 target remains plausible if ETH holds above $4,000, though traders should watch for derivatives overheating signals at $4,400.'

bullish MACD crossover

supply shock dynamics

institutional adoption